Form 8863 Instructions 2025. Students and their parents are generally eligible to claim either the american opportunity tax credit (aotc) or the lifetime learning tax credit via form 886. Claiming the aotc requires filing a tax return and form 8863.

Form 8863 instructions Fill out & sign online DocHub, Claiming the aotc requires filing a tax return and form 8863. The education credits are designed to offset updated for current information.

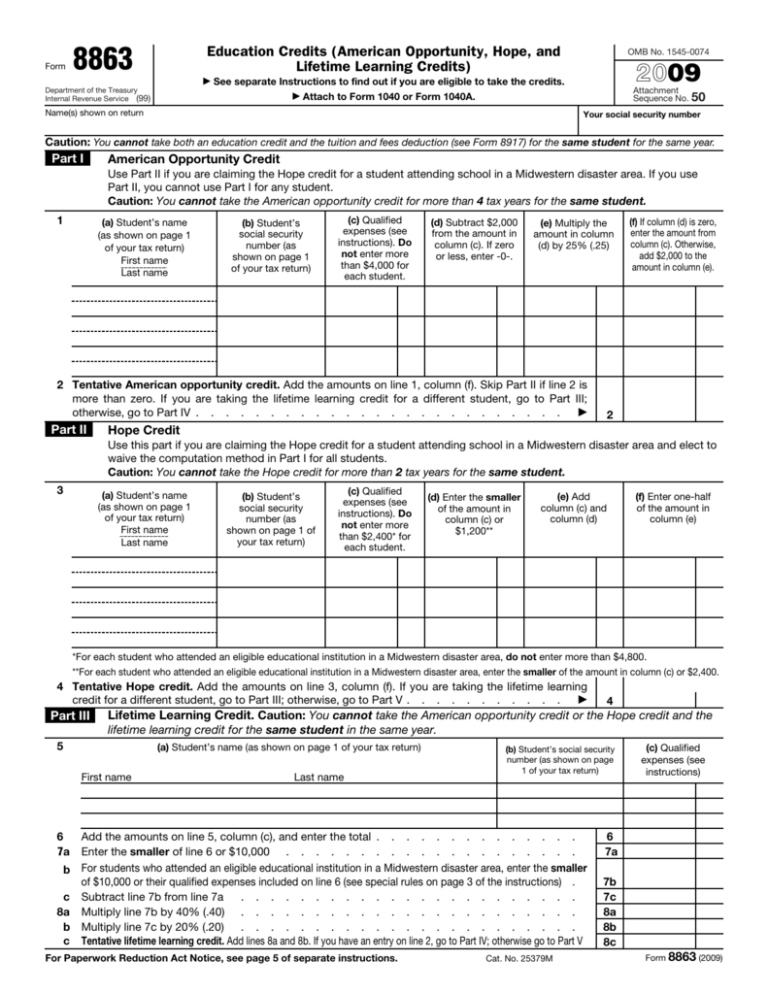

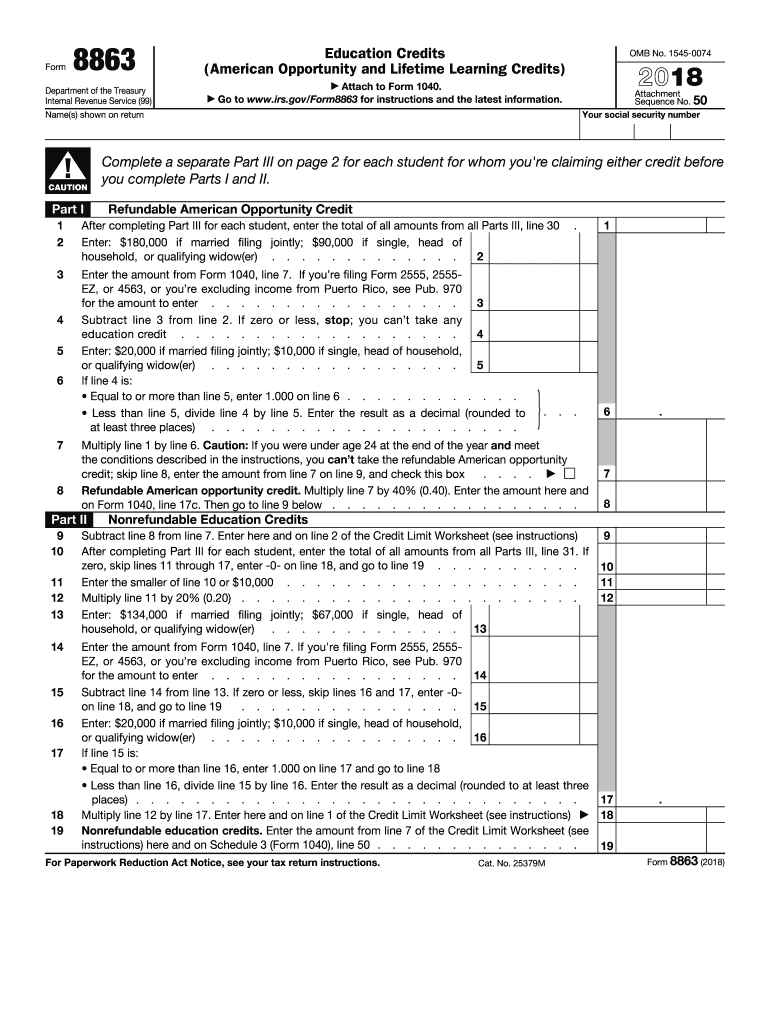

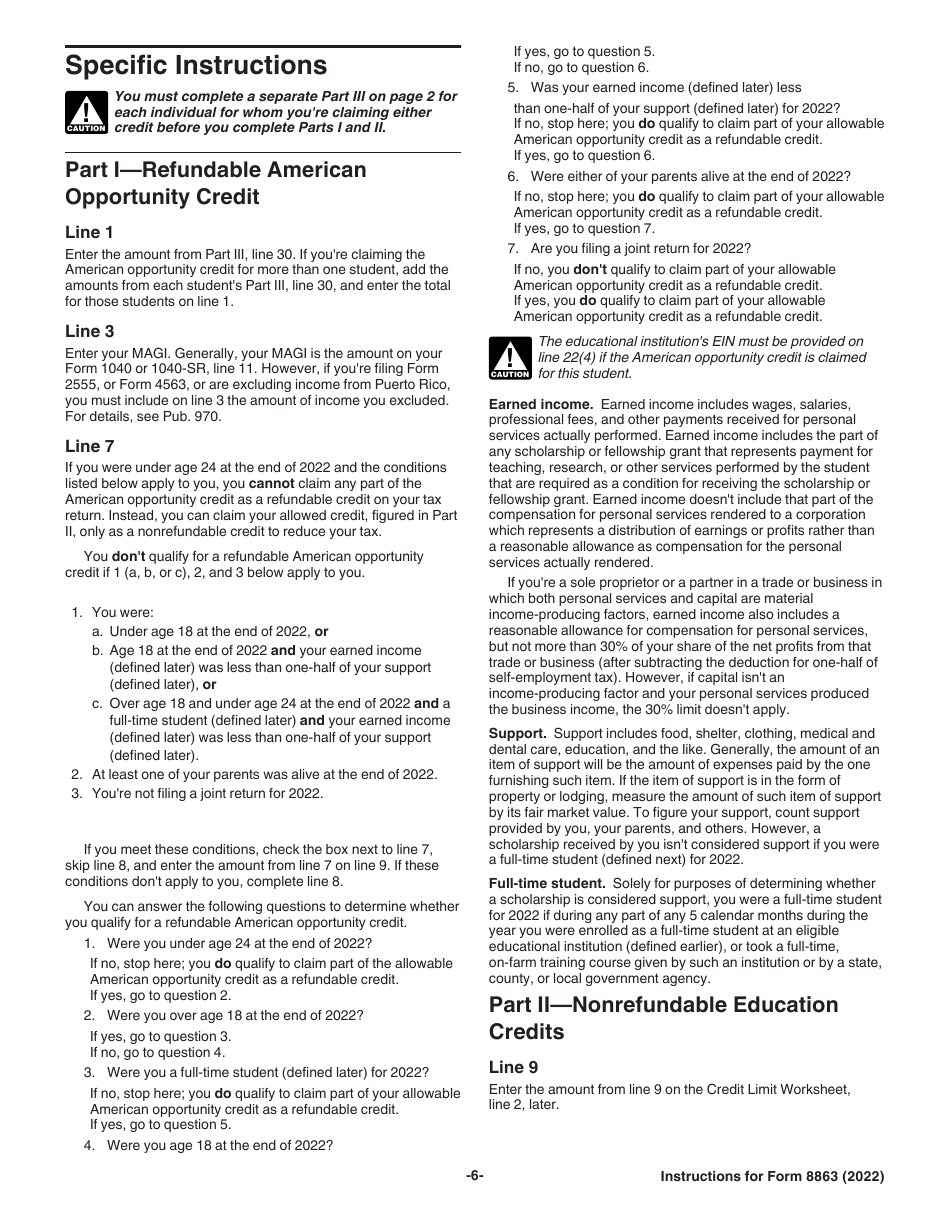

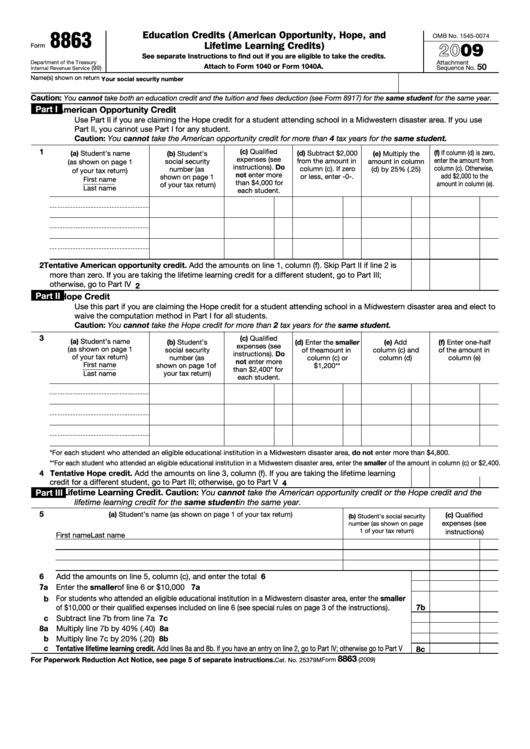

8863 form Fill out & sign online DocHub, Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. The form 8863 is used by taxpayers to claim education credits on their federal income tax returns.

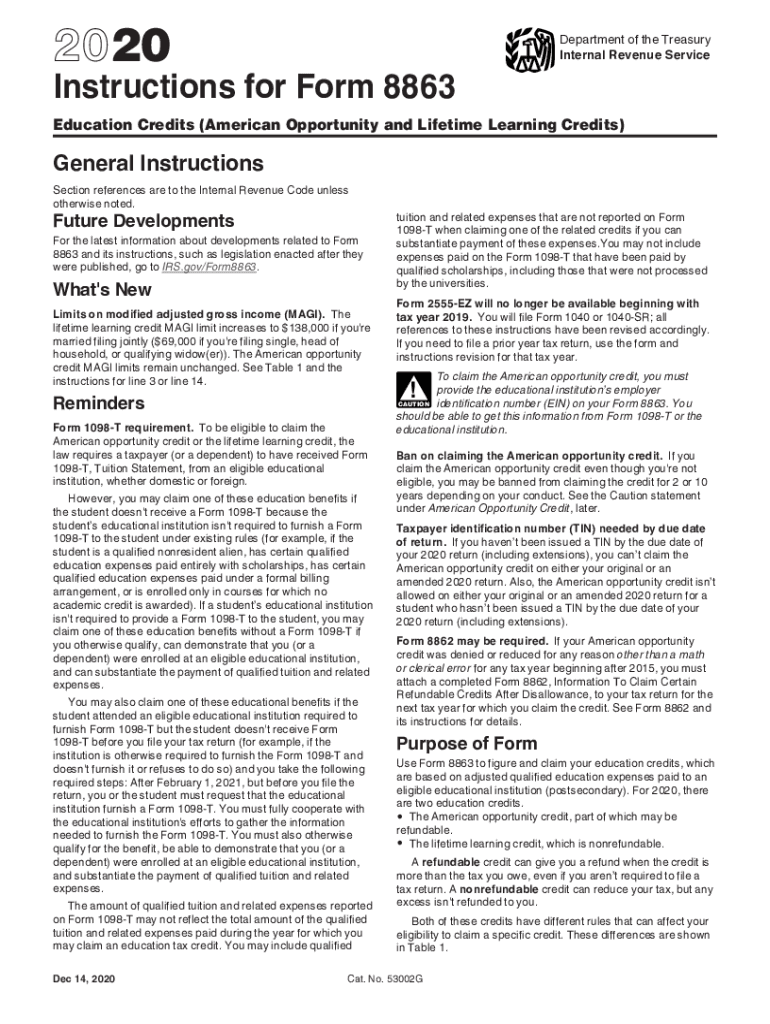

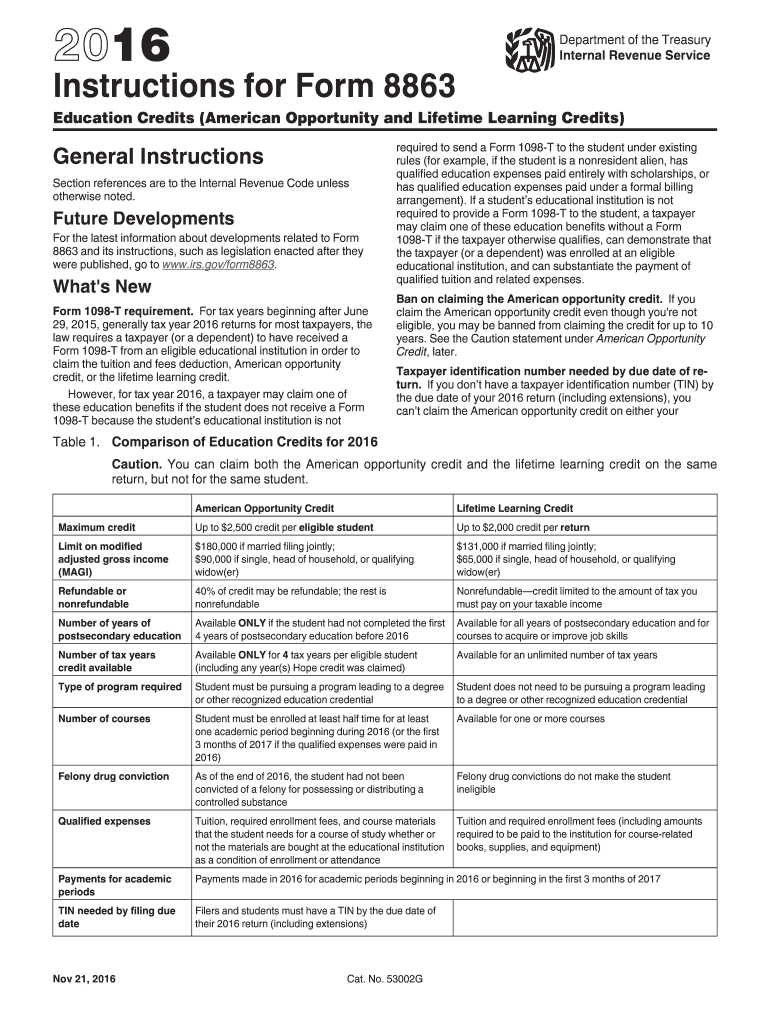

Download Instructions for IRS Form 8863 Education Credits (American, Two tax credits that can help you offset the cost of higher education are the american opportunity credit and the lifetime learning credit. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution.

8863 Fillable Form Printable Forms Free Online, For the latest information about developments related to form 8853 and. Two tax credits that can help you offset the cost of higher education are the american opportunity credit and the lifetime learning credit.

Form 8864 Instructions 2025 2025, Claim dependent and other credit. Two tax credits that can help you offset the cost of higher education are the american opportunity credit and the lifetime learning credit.

8863 Instructions Form Fill Out and Sign Printable PDF Template signNow, In line 3, enter the amount of total education credits you calculated on irs form 8863, line 19. Harbor financial announces irs tax form 8863 instructions and printable forms for 2025 and 2025

Form 8863 Instructions 2025, Claiming the aotc requires filing a tax return and form 8863. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution.

Use a Free Form 8863 Template to Maximize Education Credits, Gain insights on calculating and maximizing your. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution.

Form 8863, Special rule for a partnership interest owned on. In line 3, enter the amount of total education credits you calculated on irs form 8863, line 19.

IRS Form 8863 Instructions, Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. In line 3, enter the amount of total education credits you calculated on irs form 8863, line 19.

Students and their parents are generally eligible to claim either the american opportunity tax credit (aotc) or the lifetime learning tax credit via form 886.