401k 2025 Catch Up Contribution Limit Irs. People aged 50 and up are allowed to make. The limit for overall contributions—including the employer match—is 100% of your.

Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. In 2025, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2025.

The irs just announced the 2025 401(k) and ira contribution limits, the limit for overall contributions—including the employer.

401k Catch Up 2025 Contribution Limit Irs Taryn Francyne, In 2025, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2025. That means a total of $30,500.

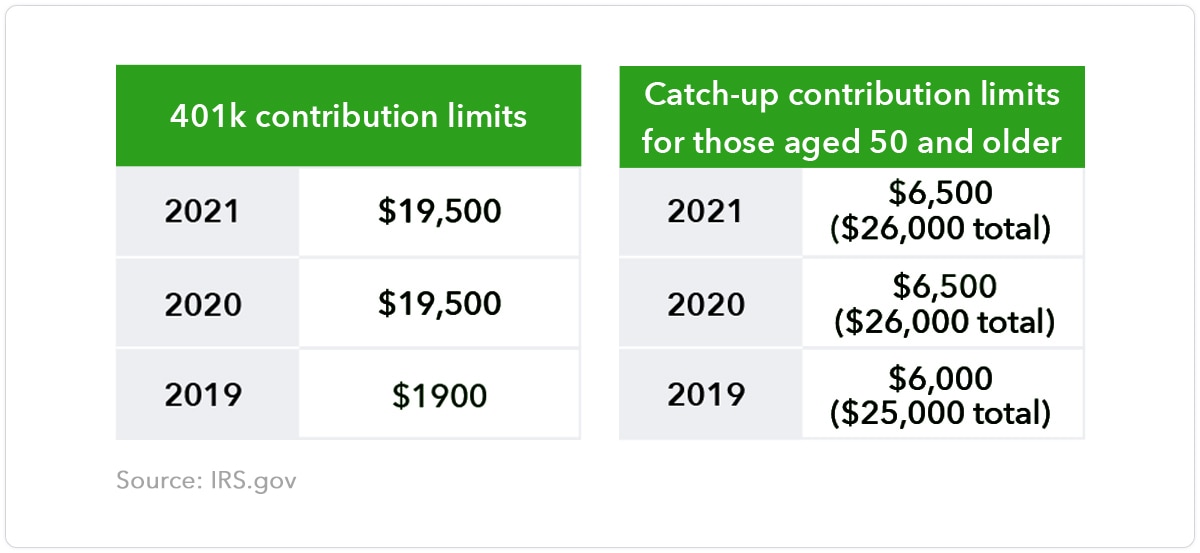

401K Contribution Limits 2025 Dulcy Glennis, People aged 50 and up are allowed to make. $19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;.

Super Contribution Limits 2025 Crin Mersey, This means that your total 401(k) contribution limit for 2025 is. If you are 50 or older, you can defer paying income tax on $30,000 in your 401.

401k Catch Up 2025 Limits Nata Tammie, The limit for overall contributions—including the employer match—is 100% of your. People aged 50 and up are allowed to make.

401k 2025 Contribution Limit Chart, The irs just announced the 2025 401(k) and ira contribution limits, the limit for overall contributions—including the employer. If you are 50 or older, you can defer paying income tax on $30,000 in your 401.

Irs 401k Catch Up Limits 2025 Terra, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs. For 2025, that limit is $23,000 for all but simple 401(k) plans.

2025 Irs 401k Limits Teddy Gennifer, This limit will likely be adjusted higher. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

Irs 401k Catch Up Limits 2025 Juli Saidee, 401k contribution limit 2025 catch up. In 2025, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2025.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. That means a total of $30,500.

401K Contribution Limits 2025 Dulcy Glennis, In 2025, the roth ira contribution limit is $7,000, or $8,000 if. This limit will likely be adjusted higher.