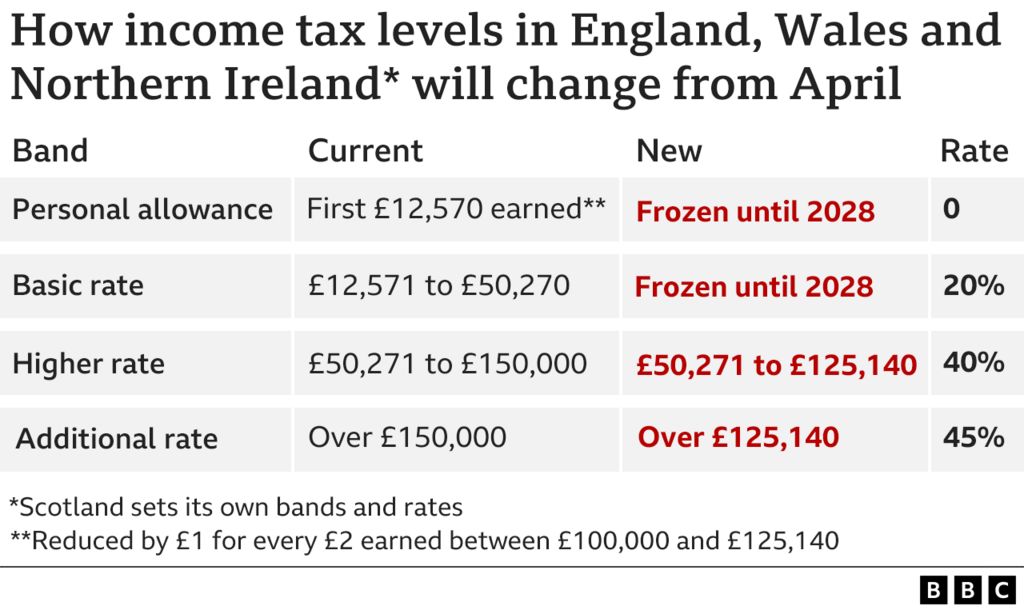

2025 Tax Rates Uk. Tax is paid on the amount of taxable income remaining after the personal allowance has been deducted. 40% tax on earnings between £50,271 and £125,140.

The basic rate (20%), the higher. Business presenter ian king has answered 21 questions from readers of the sky news.

Tax rates for the 2025 year of assessment Just One Lap, Read on for more information. The effective personal tax rate is defined as the employee national insurance and income tax paid as a proportion of an.

Short Term Capital Gains Tax 2025 Chart Clara Demetra, Wednesday 10 july 2025 11:35, uk. For easy reference, the uk tax rates over the last 19 years.

tax How will thresholds change and what will I pay? BBC News, Dear old hmrc reckons it will raise more than £10 billion from tax on savings interest this year. This interactive chart lets you see the current ruk and scottish marginal tax rates for 2025/24 and 2025/25, with/without child benefit and student loans.

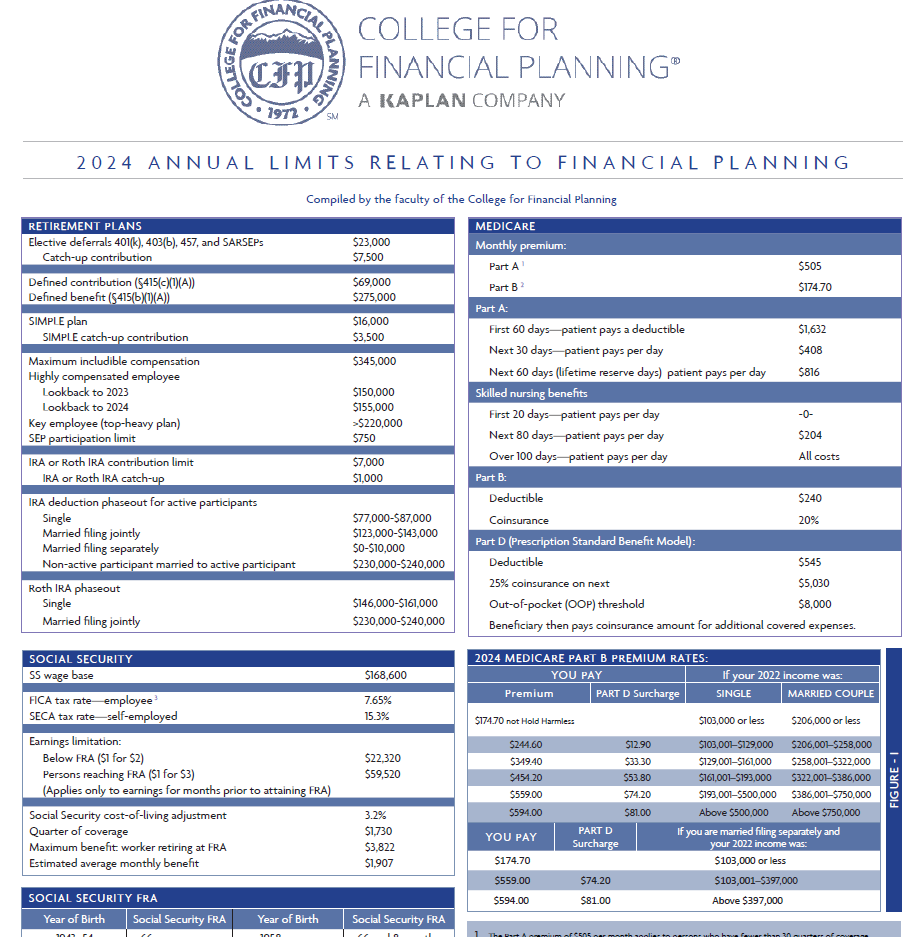

2025's Tax Numbers for Financial Planning CG Financial Group, LLC, Earnings above £50,270 up to £125,140 fall into the higher. The effective personal tax rate is defined as the employee national insurance and income tax paid as a proportion of an.

IRS 2025 Tax Brackets Internal Revenue Code Simplified, Since april 2025, the uk income tax rates 2025 /25 threshold has stayed frozen, with the next increase expected in april 2028. Read on for more information.

2025 Tax Reference Guide, The following rates are for. Tax is paid on the amount of taxable income remaining after the personal allowance has been deducted.

Tax Rates 2025 To 2025 Winter PELAJARAN, Wednesday 10 july 2025 11:35, uk. Tax calculators and tax tools to check your income and salary after deductions such as uk tax, national insurance, pensions and student loans.

2025 Tax Rates Wessel & Company, 21% tax on earnings between £25,689 and £43,662. Up to £12,570 basic tax rate at 20%:

2025 Stimulus Check Update Approved By Irs Login Tally Felicity, 20% tax on earnings between £14,733 and £25,688. 40% tax on earnings between £50,271 and £125,140.

LongTerm Capital Gains Tax Rate 20232024, Uk tax rates & thresholds for 2025/2025 (full breakdown) with the spring budget set to be announced, we’ve rounded up a comprehensive guide to all of the tax rates and. This interactive chart lets you see the current ruk and scottish marginal tax rates for 2025/24 and 2025/25, with/without child benefit and student loans.